Did you know that April was Financial Literacy Month? No, wait!

Don’t go! Yes, this is an RV

lifestyle blog, but bear with me, please.

In fact, because this is a longer post than usual, you may want to grab

your favorite beverage and settle in . . . Many of you know that my employment

background is a combination of finance and human resources, and I can tell you

that my affinity for numbers has been a huge benefit on countless occasions

throughout my life. Anyone involved in

the RV lifestyle knows that RVs don’t come cheap, a dependable tow vehicle or toad

(towed vehicle) is critical and travel expenses can add up rather quickly.

I read an article about Financial Literacy Month a

couple of weeks ago. Just before that, I had been giving a lot of thought to some conversations

and situations that had recently occurred in my personal life, and this seems

like a good time to share them.

About a month ago, while Alan and I were visiting with two of my cousins, our

conversation turned toward medical expenses.

One of my cousins had recently completed a lengthy round of physical

therapy, consistently making the co-pays the therapist’s office indicated were

his responsibility. Shortly after the

end of his therapy program, he received a check for hundreds of dollars.

Why? He had been overpaying his

co-pays all along. Thank heaven someone eventually

picked up on that and did the right thing.

Our conversation then turned toward the need to educate yourself in

nearly every facet of your life because even the professionals who you depend

on to have your back . . . don’t. Nobody

will ever advocate for you as well as you.

"Some people drink from the fountain of knowledge,

others just gargle." ~ Robert Anthony

Alan and I recently met with our home and auto insurance agent to

review our coverage. At the time, we

were insuring six vehicles through the company (a well-known, national company),

and we had a homeowners and an umbrella policy with them, as well. Before we went in for our appointment, I sat

down with all eight policies to look them over and I drew up a short list of

questions for our agent. One of those

questions was in reference to the lack of an “accident-free” discount on Alan’s

2017 pickup truck (our tow vehicle). He

had been driving a 2013 pickup with an accident-free discount but, when we

swapped that one for the 2017, the discount wasn’t applied to the new

truck.

When we ran this by our agent, we

received a mumbo-jumbo, smoke and mirrors explanation as to how that discount

was determined and why we weren't eligible for it. It took several pointed

questions before she narrowed it down to this:

If there is another vehicle in the family with an accident charged to it

at the time a new vehicle is added, then an accident-free discount is not

allowed for the new vehicle. Okay. That doesn’t seem fair if the new vehicle is

for a driver in the family with an accident-free record but, if that’s the

company’s policy, that’s the way it is.

(At the time, one of our kids had an accident on record that hadn’t yet

been expunged.) Still, I wasn’t

comfortable with the explanation because of the way the agent tried to explain it to us. I had a feeling that she really didn’t know

what she was talking about and simply kept talking in circles to overcome

that. To her credit, she did look into

the matter for us. Guess what! Alan should have received his accident-free

discount on the new truck. Guess what

else! The company’s policy is to only go

back 30 days in a situation like this.

So, for 18.5 months (of course

I worked it out!), we lost that discount.

The error was corrected going forward and we received a check from the

insurance company for $119.00 and change.

Just to be clear . . . the company reimbursed us for 30 days of the

discount we lost? And that was

$119.00? So, that means that a professional insurance agent’s error

cost Alan and me over $2,200.00?! This

issue hasn’t been resolved yet, as Alan went back to meet with the manager of

the insurance agency who agreed to look into in and call us back. (Still waiting . . . ) Depending on the outcome (actually, probably

despite the outcome), I’ll be filing a complaint with our state insurance

department. And we’ll be shopping for

another insurance company. It is not

the fact that someone made an error that bothers us. It is the fact that the company admitted the

error and will not compensate us appropriately for its mistake. What did we

learn? Well, now we know that we cannot

depend on our insurance agency to handle our transactions accurately and it’s

necessary to scrutinize any documents we receive from the professionals who

allegedly know their business and have our backs.

"Against the backdrop of people who avoid work, cut corners and do half-hearted jobs,

a diligent man stands out." ~ David Jeremiah

I certainly understand that there are different kinds of people in

this world. There are those whose

comfort level allows them to trust the professionals in their lives and be quite

content with the outcome. Personally

speaking, I’ve experienced too many displays of apathy or ignorance to throw my

hat in that ring. I’m a voracious

reader, a dedicated researcher and a diligent planner; fortunately, these

aspects of my personality have served me (and my family) well in a variety of

situations. To broaden your knowledge

when approaching a major decision is not a bad thing. As Sir Francis Bacon said, “Knowledge is

power.” In fact, we have a set of mugs

in our house with the following inscription:

“The more you read, the more

you know.

The more you know, the smarter

you grow.

The smarter you grow, the

stronger your voice

when speaking your mind or

making your choice.”

In 2006, Alan and I were in the market for a four wheel drive

vehicle that would get us through the winters here in the northeast and be able

to tow the camper we were considering.

You might think that plowing through the research and visiting a number

of auto dealerships would be draining, but this is a family that loves its

vehicles. Alan, I, our son (almost 25) and

our daughter (20) all have love affairs going with our cars and trucks. Driving for all of us has never been about

jumping in something that will get you from point A to point B. Driving represents the freedom of the open

road and the solid feel of a good vehicle in your hands. That’s not just my car; it’s my ride. Ask what our

favorite car was at any of the car shows we’ve attended and our daughter, Kyra,

and I will look at each other and say, “that silver blue 1964 Corvette.” Several years ago, our son, Ryan, texted

several photos to me of the best Chevelles from a huge classic car show he and

some friends were attending. Apparently,

our appreciation for our vehicles and the freedom they represent has been

passed down to our children. Yay!

"A road trip is a way for the whole family to spend time together

and annoy each other in interesting new places." ~ Tom Lichtenheld

Back to our situation in 2006 . . . Any time we’re in the market

for another car or truck, we find that the research involved is not only

tolerable, but pleasurable. (Yeah, I

know. Weird, right?) It’s the truth. When we were shopping for that 4x4, we

finally narrowed our search down to a Chevy Tahoe. (We follow what we call “the funnel

approach.” We look at every vehicle that

might possibly meet our needs, and then cross them off one by one as we fine

tune our preferences, ending up with the single vehicle we believe best fits

our needs. Sometimes the process goes

quickly, sometimes slowly; either way, it’s fine with us.) We decided to order a new Tahoe through a

local dealer, so that we could get exactly what we wanted in it. We chose to approach a salesperson who we

knew had been at the dealership for a long time. Auto sales often seems to be a field of

transients, so we thought his longevity would be to our advantage. So not true.

As we sat with him, going over the list of options we wanted, he told us

that something we had chosen was not available in the model we were

ordering. I think it may have been the

third row of seats, but I’m not sure.

However, because Alan and I had been poring over the manufacturer’s specs

for the vehicle, we knew the option was definitely available. Mr. Experienced Salesperson insisted that it

wasn’t. The issue was resolved when I

sat down at his computer and used his company’s ordering software to prove

to him that the option was, indeed, available.

He learned something new that day and we got our third row of

seats. Knowledge is power.

Several years ago, when our kids were no longer able to travel

with us on a regular basis due to school and work commitments, it became

apparent that our travel trailer (a Jayco bunkhouse model) was no longer

meeting our needs. So began the more

than year-long search for a new travel trailer.

While I admit that the amount of research we do would be overkill for

many people, I have to say that our “funnel approach” works really well for us

because I actually enjoy the time I spend gathering information on whatever the

current project is, and Alan and I both believe that we come up with our best

decision this way. In the search for a

new travel trailer, we visited two major RV shows in the northeast, and I spent

countless hours online tracking down information on companies that offered

travel trailers with rear living floor plans.

If you’re interested, you can read the details of that project in an

earlier post (Today is Our 1st Anniversary! - link HERE), but my point today is that, by the time we had

decided on exactly what we wanted, we were confident enough in our purchase to

place a deposit on a Creek Side 26RLS made by Outdoors RV Manufacturing sight

unseen and all the way across the country.

Not only were we able to make that leap of faith but, since ORV was in

the process of redesigning their product line, we were able to get our hands on

the exact model in the older product line that we wanted at an excellent price

since the dealer was anxious to make room on the lot for the newer units. When I checked the NADA guide for used travel

trailers last year, our 2017 Creek Side was valued at about $10,000 more than we paid for it new. Not that we’re in the market to sell it. We love that travel trailer and nearly every

time we’re in it we comment on what an excellent choice it was for us. The knowledge we had gathered about the

features and prices of various rear living models on the market allowed us to

find what really was the best fit for us at an exceptional price. We have no regrets about the amount of time

we spent researching that purchase of our “retirement home,” and we reap the

rewards every time we hitch up and head out.

About a month ago, a deer leaped out in front of our son and his

Volkswagen Jetta was totaled. Thank

heaven he wasn’t totaled; luckily, he

wasn’t even hurt. The Jetta was Ryan’s commuter

car thanks to its excellent gas mileage.

He also has a 2009 Chevy Silverado which he uses for towing his jet ski and

a utility trailer. The loss of the Jetta

prompted some soul searching on his part.

Previously he had been hoping to replace the Silverado since it was

closing in on 200,000 miles and had been roughly handled before he had

purchased it. But now, with the loss of

the Jetta, he had to decide whether to go for a commuter car or a pickup truck to

replace it. Fortunately, he had already

spent a bit of time researching the availability and pricing of used trucks in

our area. And he quickly came to the

conclusion that a dealer about an hour and a half from home not only offered an

excellent selection of used trucks, but that all of them were priced somewhat

lower than any other dealer around. A

check for online reviews revealed that the dealer in question was a popular and

well-respected one. Perfect. He made the decision to replace the 2009

Silverado first, and then consider adding a reliable but inexpensive commuter

car down the line. Ryan narrowed the

selection down to five used pickup trucks that he would consider buying,

numbered them in his order of preference and planned a visit to the dealer. Since everyone in the family considers a

visit to an auto dealership a fun-filled outing, Alan and I were invited to

join Ryan on his expedition. His first

choice was still on the lot and, after test driving it, Ryan decided to buy it. When he asked what movement there might be on

the price, the salesperson said it was already being offered at a fair price

for that truck and Ryan readily agreed.

Having already researched the prices of used trucks, he was confident he

was getting a good deal. Plus, the truck

was a certified pre-owned and had just come off a lease, so it was in excellent

condition with low mileage for a 2016.

For the sake of convenience, Ryan was hoping to trade in his 2009

Silverado. The salesperson agreed to

inspect it to see if they’d accept it on trade and he did end up making an

offer on it. A really low offer. Now, I admit that the truck was not in great

shape and I know a dealership will lowball the value so they can make a profit

on a sale. However, because I estimate

the value of all of our vehicles once a year via the NADA or Kelly Blue Book

guides, I knew that, about a year ago, the truck had been worth much more than

the amount the salesperson offered. When

I asked Ryan what he thought he could get for it if he sold it himself, he

mentioned a price that was $1,500.00 over what the salesperson had offered for

it. Here’s the part where you have to

pay attention. The salesperson then

says, “But by taking that trade-in off the price of the 2016, you’ll lower the

amount of sales tax you’ll have to pay on the newer truck.” Good point.

Let me think about that. Based on

the trade-in offer of $2,500.00 and a tax rate of 8%, Ryan would save $200.00

on sales tax. But he could sell the

truck via private sale for around $4,000.00, netting him an extra

$1,300.00. The salesperson made his

point which, in my mind, was nobody

advocates for you like you.

Actually, we all know that the job of a salesperson is to sell you

something. And, as far as salespeople go,

this guy was better than most – knowledgeable, easy to work with and

courteous. But, if Ryan had blithely

believed everything the salesperson either told him or put before him, our son

would certainly not have come away with the best deal. When you’re a young adult, just starting out

in your career, every dollar counts.

Heck, every dollar counts when you’re retired, too, and everywhere in

between! A rather cynical, but

heartfelt, belief of mine is, “Better in my pocket than theirs.” It really warmed my heart to see Ryan complete

that transaction in such a successful manner.

Because he had done his research on truck pricing, confirmed that the

dealer was a reputable one, questioned claims the salesperson made and did not

allow himself to be pushed into a decision to trade, he came out further ahead than

someone whose lack of knowledge would not have allowed him the advantage of

garnering a better deal. Ryan ended up

selling his 2009 Silverado through word of mouth even before he had posted it

for sale. He got $3,800.00 for it,

coming out $1,100.00 ahead even considering the adjustment for sales tax. Not bad for knowing enough to “speak your

mind and make your choice.”

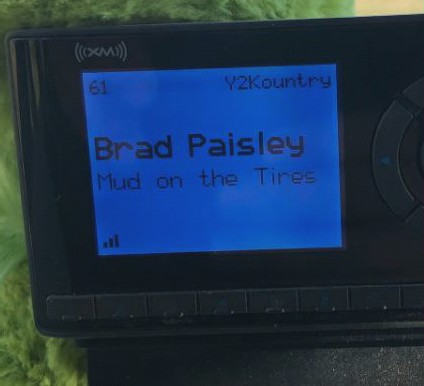

This is

slightly off topic, but something I couldn’t resist sharing with you . . . A

few days after Ryan picked up the new-to-him truck, a song by Brad Paisley

called “Mud on the Tires” came up on my playlist at home. (It starts off, “I’ve got some big news. The bank finally came through, and I’m

holding the keys to a brand new Chevrolet.”)

So, at 8:37am that morning, I texted Ryan and said, “I know you’re not a

big fan of Brad Paisley, but I really like Mud on the Tires and now, every time

it comes on, I think of you." Ryan

responded at 8:38am, “No mud on the tires of this truck!” Five minutes after that, at 8:43am, I received

another text from him, along with a photo of his SiriusXM screen and the

comment, “Look what came on.” Yup, Mud

on the Tires. I wonder what the chances

were, statistically, of that happening.

You might say that it was a coincidence.

I might respond that there are forces greater than us at work in the

universe. Either that or I am eerily

connected to my kids.

About the time that all this was going on, I was reading the book

“Enough. True Measures of Money,

Business and Life.” The book was written

by John C. Bogle, the founder and former CEO of the Vanguard Mutual Fund Group who

passed away on January 16th of this year at the age of 89. I’ve always liked Jack’s attitude toward the

mutual fund industry and truly appreciated the way he looked out for the

everyday individual investor. It seemed

telling to me that, as I was drafting this post and reading the book (well, not

at exactly the same time), the titles

of some of Jack Bogle’s chapters reflected my annoyance with the professionals

who were supposed to have my back.

Chapter 1: Too Much Cost, Not

Enough Value. Chapter 3: Too Much Complexity, Not Enough

Simplicity. Chapter 5: Too Much Business Conduct, Not Enough

Professional Conduct. And, finally,

Chapter 6: Too Much Salesmanship, Not

Enough Stewardship. Apparently, Jack

Bogle was a man after my own heart.

Getting back to RVing, when the time comes to purchase an RV or a

tow vehicle, I personally believe that knowledge puts you on a more equal

footing with those who are trying to sell you something. Unfortunately, it is so easy to get taken in

today’s society. People and businesses everywhere

are trying to separate us from our money because their job is to sell. I am quite willing to spend my hard earned

cash for what I want, but I’m not willing to pay more than I need to in order

to get it. As a firm believer in

education – the type provided by both educational institutions and life itself

– I support the acquisition of knowledge at every stage of life, in every

manner possible.

“An investment in knowledge

pays the best interest.” ~ Ben Franklin

Financial literacy, whether in reference to saving, investing,

budgeting or spending, is crucial to financial stability throughout our

lives. Knowledge is power and sometimes

it translates to extra cash in our pockets, too. Money is a tool that buys security, freedom

and options. And I really love having

the freedom to travel and enjoy the opportunities and experiences that go along

with it.

Thanks

for hanging in there for such a long post.

For anyone who may be interested, the Survive and Thrive Boomer Guide

ran an excellent article regarding Financial Literacy Month a few weeks ago (link HERE). The post included a list and description of

more than 20 programs that exist to promote financial literacy, including links

to the NeighborWorks Financial Capability Program (which works to ensure that

individuals and families have access to the education, skills resources and

support needed to make sound decisions that allow them to achieve and sustain

financial security) and the Busy Kids web site (where a post on Financial

Literacy Month details activities you can do with your children or

grandchildren to promote their financial literacy). If you visit the Survive and Thrive Boomer

Guide, you’ll find a wonderful resource to help you improve your financial

smarts! Remember . . .

“The more

you read, the more you know.

The more you know, the smarter you grow.

The smarter you grow, the stronger your voice

when speaking your mind or making your choice."

I get the feeling I have just attended a college class on finance, but I fear I'm going to have to drop the course due to, well, laziness. I remember when balancing my checkbook made me suicidal; I'm only here today because of online banking. It takes a grasshopper like me to recognize the superiority of the ant. I am not worthy.

ReplyDeleteNot only are you more than worthy, Mike, but you're just too funny, as well. Maybe it's the numbers person in me showing, but I've always believed that a personal finance course should be a requirement for a high school diploma. That would prevent many of us from having to learn some of life's more painful financial lessons the hard way.

DeleteI don't deal with human beings anymore. That's why God invented the computer. My car insurance company, whom I had been with for 10+ years was overcharging me by the thousands. $4000 a year to insure two vehicles? A simple log on to Progressive and the same insurance costs me $1000 a year. Been working the system via my computer ever since. No need to speak to a human. Ditto for purchasing a car. Or anything else for that matter.

ReplyDeleteThere is no way on earth you can teach a human being about being financially literate. That is because money management is 80% personality and only 20% math. Until human personality madness can be harnessed, humans will continue to make bad financial maneuvers. Sorry.

Your post was very, very long.

I agree with you, Cindi, that technology provides distinct advantages when managing financial chores, both from the perspective of easily accessing information and the ability to handle transactions online. I appreciate that aspect of it although I'm always watching for additional ways to prevent identity theft. As for the length of the post, well, sometimes I just get on a roll. You should hear me rant in reference to store clerks that can't say more than, "$14.53" and "Have a nice day" and restaurant waitstaff that don't know how to smile!

Delete